Minimum Income To File Taxes 2025 Married Jointly. As your income goes up, the tax rate on the next layer of income is higher. The calculator automatically determines whether.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income. If you are married and claimed as a dependent on.

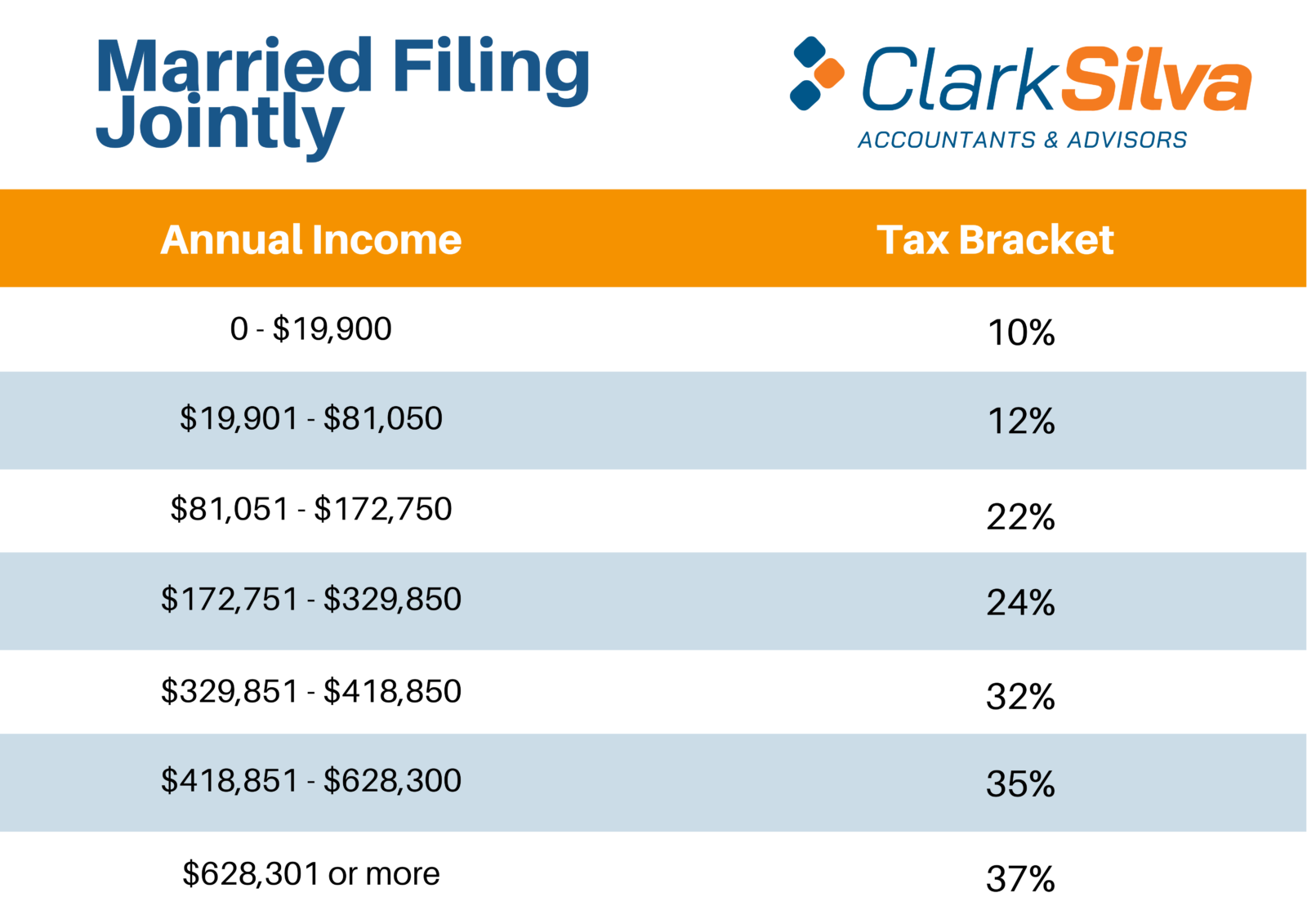

2025 Tax Brackets Married Jointly Married Filing Dorrie Chryste, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

What Are The Tax Brackets For 2025 And 2025 Married Jointly Lana Carlina, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income.

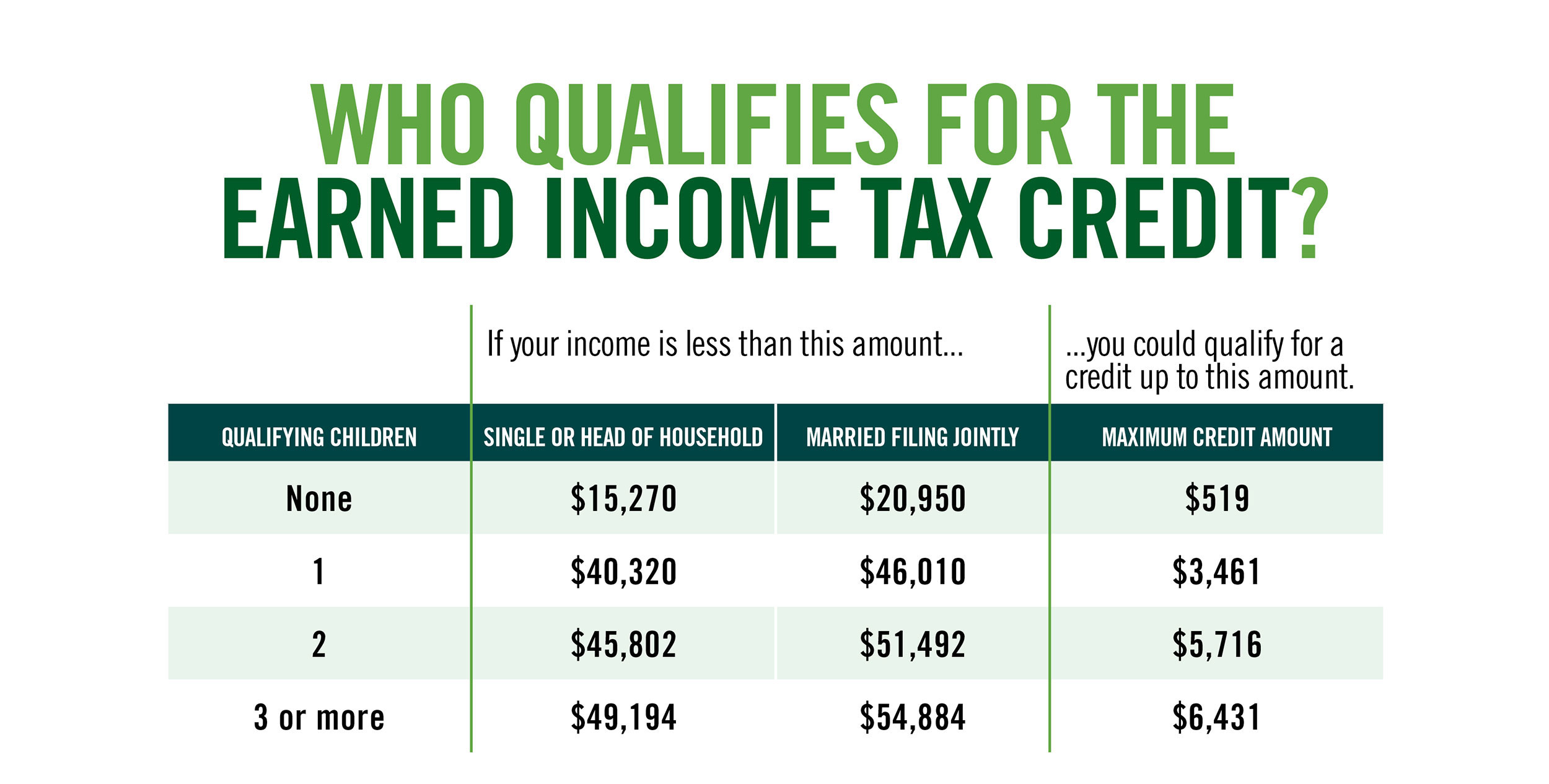

Tax Brackets 2025 Married Filing Jointly Single Winne Karalynn, For married couples filing jointly, the phaseout of the credit begins at $29,640 of adjusted gross income (or earned income, if higher) and the phase out ends at $66,819.

Irs Minimum To File Taxes 2025 Image to u, For married couples filing jointly, the phaseout of the credit begins at $29,640 of adjusted gross income (or earned income, if higher) and the phase out ends at $66,819.

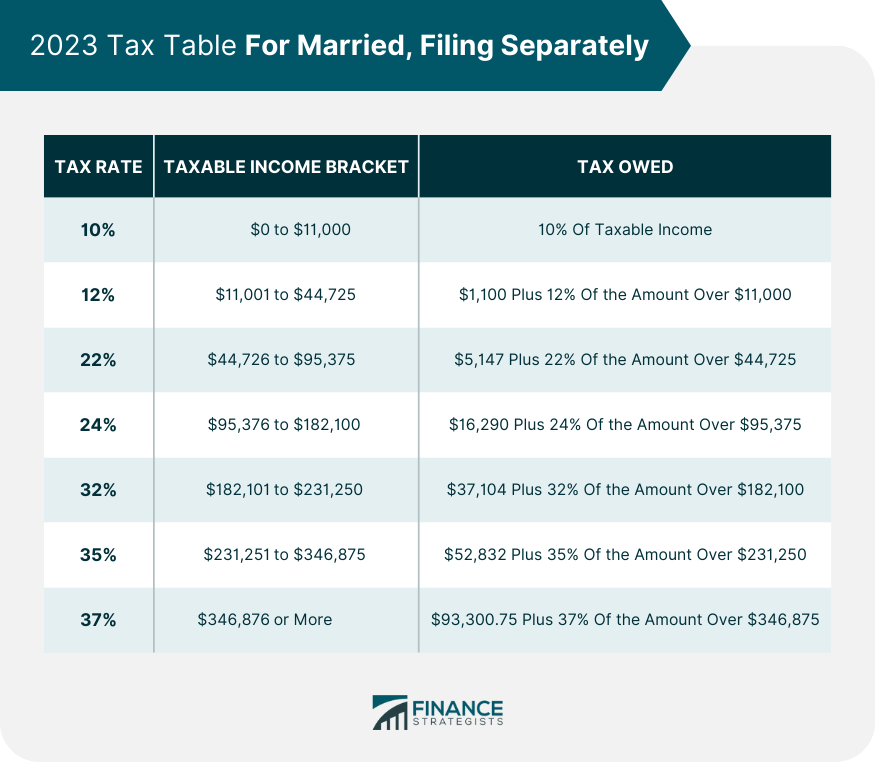

2025 Tax Married Jointly Filing Separately Jessi Lucille, You probably have to file a tax return in 2025 if your gross income in 2025 was at least $13,850 as a single filer, $27,700 if married filing jointly or $20,800 if head of household.

Us Tax Brackets 2025 Married Filing Jointly Vs Separately Angie Bobette, For the 2025 tax year, the additional standard deduction amounts are $1,850 for single filers or heads of household and $1,500 for married filers or qualifying widow(er)s.

Tax Brackets 2025 Married Filing Jointly Cordi Paulita, You may still qualify as a dependent if you are married and filing separately.